Market Rally - Confirmed!

“The beatings will continue until morale improves.” -- Captain Bligh (from Mutiny on the Bounty fame)

During recent meetings, I have been struck by the level of cautiousness and general bearishness amongst investors. It is not altogether surprising given that since the end of 2021, we have seen a steady rise in interest rates. Higher interest rates affect the consumer with nearly every purchase from groceries to homes. Notwithstanding the unrelenting interest rate rise, the U.S. economy and the job market have been remarkably resilient. Consequently, corporate earnings in many sectors have exceeded Wall Street’s muted expectations during this earnings season.

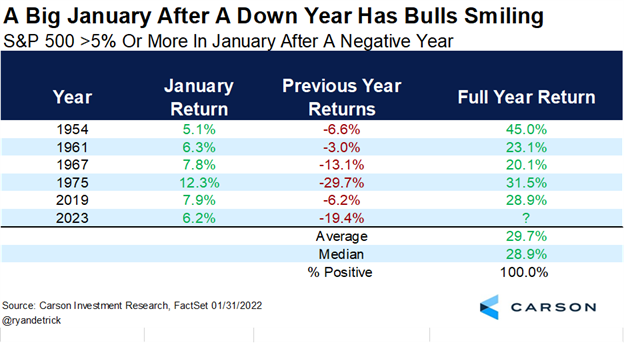

A significant rally is underway supported by the recent October consumer price index (CPI) data. While CPI consensus was leaning “hotter”, the core CPI came in cooler at 0.23% month over month vs many forecasts at 0.34%. Shelter, one of the largest components of CPI, slowed to 0.3% which was the slowest reading all year. Perhaps inflation is hitting a wall as only 7 out of the 31 core CPI components saw a rise in October. Given this data, I want to make a few things clear: (1) We want to be invested in this market (if interest rates have stalled, this market can trend higher); (2) There is too much money on the sidelines (over a trillion dollars); (3) There is way too much hatred for this rally (which is good news for investors); and (4) Most strategists still are on the wrong side of the trade, and they now must buy aggressively (Morgan Stanley’s Mike Wilson projected 2023 S&P 500 to end at 3900; ouch). In short, there are many reasons for optimism.

The market rally has broadened substantially with stocks of smaller companies outperforming the larger companies and every domestic sector posting gains. It is just what an investor would want to see in a market with sustainable upward momentum. While we still have a month and a half until we close the books on 2023, it does appear that interest rates have stabilized. If so, such stabilization should bode well for both bond and equity markets going forward. Perhaps the beatings we experienced with higher interest rates will cease and market morale will improve…

If I do not speak to you beforehand, hope you have a wonderful holiday,

Michael

Legal Disclaimer | Form ADV Part 3 (Form CRS)

Check the background of your financial professional on FINRA's BrokerCheck.

Invictus Private Wealth, LLC is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Invictus Private Wealth, LLC and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Invictus Private Wealth, LLC unless a client service agreement is in place.

Invictus Private Wealth, LLC provides links for your convenience to websites produced by other providers of industry related material. Accessing websites through links directs you away from our website. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.

All Rights Reserved | Invictus Private Wealth, LLC | Privacy Policy | Powered by Levitate