News & Updates

Stay Connected and Informed

Staying Calm Amid Market Volatility: A Look at Tariffs and Investor Strategy

"Be fearful when others are greedy and greedy when others are fearful." - Warren BuffettAnother bruising day on Wall Street sets the markets up for their fourth weekly loss in a row. During times...

Read more

2025 IRS Contribution Limits and Roth Conversions

I hope your 2025 is off to a great start! The table below outlines the most relevant IRS increases for retirement plan limits. This is a great opportunity to review your plan contributions and...

Read more

Maximizing Tax Benefits: Hiring Your Children as Employees

As we enter the second half of 2024, I’d like to share a strategy that could potentially yield significant tax savings for clients who operate a family-owned business: Hiring your children as...

Read more

Tax Efficient Giving Strategies

Planning conversations span many topics. One unifying theme, particularly towards the end of the year, is charitable giving. Our goal is to provide you with the knowledge to maximize the benefits...

Read more

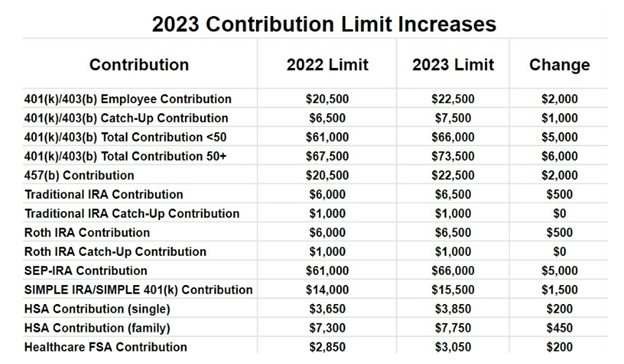

2024 Retirement Plan Contribution Limits

Each year, the IRS announces cost of living adjustments associated with certain dollar limitations for retirement plans and tax brackets for the coming year. The below table is a summary of the...

Read more

Market Rally - Confirmed!

“The beatings will continue until morale improves.” -- Captain Bligh (from Mutiny on the Bounty fame) During recent meetings, I have been struck by the level of cautiousness and general...

Read more

Required Minimum Distributions - A Primer

As a part of our planning process, we often work with clients to model distribution strategies in retirement. For clients who retire before 65, we need to consider health care costs before Medicare...

Read more

Some good news (finally)!

The man who is a bear on the United States will eventually go broke. -- J.P. Morgan After a tumultuous 2022, some good news to report. The equity markets defied skeptics and rallied to...

Read more

Helpful Tax Planning Information for 2023

For those with employment income, there is still time to make 2022 IRA contributions for Traditional, Roth and SEP IRAs. The deadline is your tax filing date. We are happy to help facilitate...

Read more